The ATO simplifies the rules (a bit).

For the past few months, our cities and office towers have been almost empty. People are working from home.

Even as we contemplate a future return to work, there is a realisation that work habits, social distancing and office layouts may further extend the need to work from home. Perhaps indefinitely.

So how much of your Working from Home expenses can you claim on your tax? How complex is it? What records do you need to keep? There might be a lot you can claim.

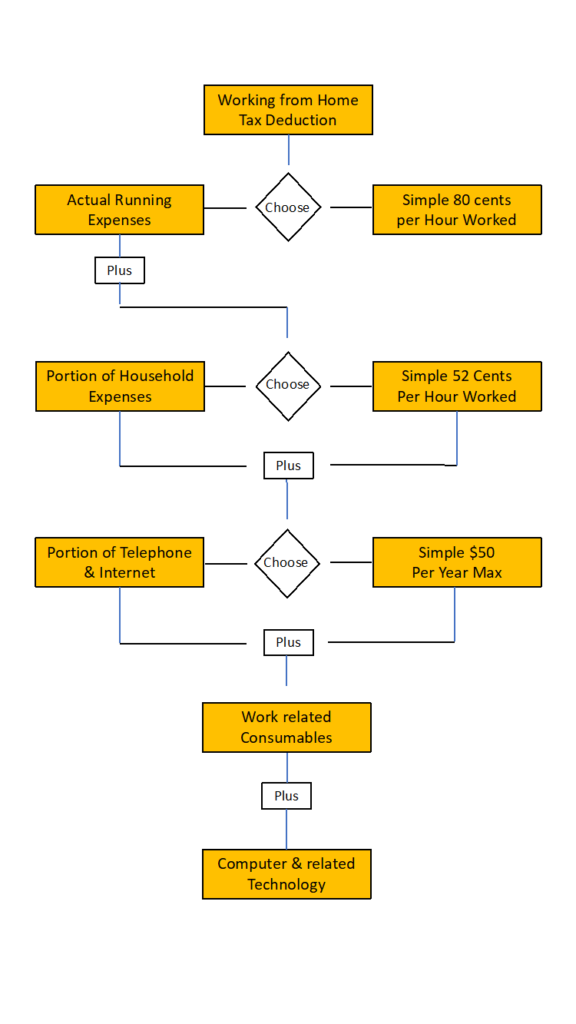

OK, Let’s (try to) keep it simple. The flow chart at the end might also help.

-

The ‘All-In’ Simple Rate … for everything

For every hour you work from home, you can claim 80 cents …. for the period between 1 March and 30 June 2020. So, if you worked a 40-hour week from home, that’s a $32 claim for that week. And for every other week that you also worked that hard. That all mounts up to a pretty good claim.

But of course, you must also either; keep a record of every one of your working hours, or much more simply, a record (like a logbook) for a representative 4 weeks. A new record might be necessary if work habits change (like returning to the office two days per week).

It is nice and simple and if you chose this method, there are no further claims that you can make for running expenses, consumables, computers or other equipment. But you might be better off exploring the alternatives below.

-

‘Actual Running Expenses’

You can claim a portion of the actual running expenses at home, to the extent that they were incurred as part of you earning income.Naturally, there are two ways of working out how much of your household expenses you can claim. The easy way and the hard way. The hard way might give you a better outcome.

Firstly, the easy way.

You can claim 52 cents per working hour. This covers an implied share of all Running Expenses plus you can still claim relevant internet, telephone, computer equipment and consumable expenses (see below). Again, you will need a record of your hours worked as you did for the simple 80 cent rate.Secondly, the hard way.

You can claim a percentage of the actual costs that you incur for your Working from Home. This includes share of heating, cooling, lighting, power and depreciation of relevant furniture. Again, you need to keep a record of all of your hours (no easy 4-week logbook here … more like a timesheet). You also need to keep the receipts for items purchased (for 5 years from the date you lodge your return).Now it gets tricky. Apportioning these costs now needs to take into account factors such as floorspace, other members of the household, the usage of utilities had you not been there, time of the day and the ratio of work verses non-work time. Of course, the ATO has all of this on-line for you to consider. Just click here for bedtime reading. As our tax system is based on self-assessment, you have the responsibility to substantiate the claims you make.

It would be wise to collate and summarise your numbers and your thinking before you pass the information to your accountant when tax time comes. They don’t want to see a shoe box full of your messy receipts!

As an employee, you generally can’t claim a portion of mortgage interest, property insurance and rates. There are significant CGT implications should you head down that track.

-

Internet and Telephone expenses

Why would you even think there is only one way to work this out? Again, there is the easy way and a more complex (but potentially more beneficial) way.

Firstly, just claim 50 bucks. Simple. It’s the ‘low-doc’ approach that allows you to achieve the minimum amount of usage required. And at 75 cents allowed for a work call (plus other allowances) most people hit this pretty easily. But $50 is all you get… for everything… for a whole year potentially.

Or, keep a record again. Yep, another 4-week representative work period and an analysis of your mobile, landline and internet costs and you might find that your claim is quite a bit higher that just $50 … especially over a protracted period of time. For more info, check out the ATO guide to apportionment.

-

Consumables

How expensive is Printer toner? Ridiculous! The stuff lasts for years and years until you work from home. Then you seem to run out all the time. And printer paper? Other stationery? Pens, folders, staplers, rulers, scissors. When you went to reach for them, you realised that the kids have taken your supply with them to school years ago.

Just keep receipts of what you needed to buy and what percentage you think you used for business and hey, that Working from Home deduction is looking good.

-

Computer Equipment

Judging by the record sales results of JB HiFi and Harvey Norman over the past few months, there are many people out there buying necessary equipment to work from home.So how much can you claim?

Well, if your private use is only incidental and you purchased it to enable you to work from home, it is a depreciable asset. You can claim the cost of this over its effective life. The ATO offers you a two-year simple write off. Claim 50% for each full year you owned it or pro rata for part years of ownership (such as this year if you only just bought it).

It doesn’t stop there either. If you got frustrated with that old printer or scanner and threw it at the cat, its replacement may well be depreciable too. That is of course if it passes that same work test. Keep receipts of everything you spend. And please don’t hurt your cat. We like cats.

-

Directors

You are employees too. If the rules above fit your circumstances, you too can claim these expenses.

-

When in doubt…

The ATO website does provide good guidance on all of these matters and you should always get advice from your tax professional or adviser.

-

Simple?

Just follow the flow Chart below

Enjoy !!!

Maggie Kwan

Associate

Alp McNamara